It seems that my husband really wants to know more details about financing about our Happy Valley hiatus to Isla Mujeres Mexico. And before he moves the needle from 50% on board closer to the necessary 100%. Well.. it’s all about the money. Details, schmeetails I say. I’ve got a plan Babe!

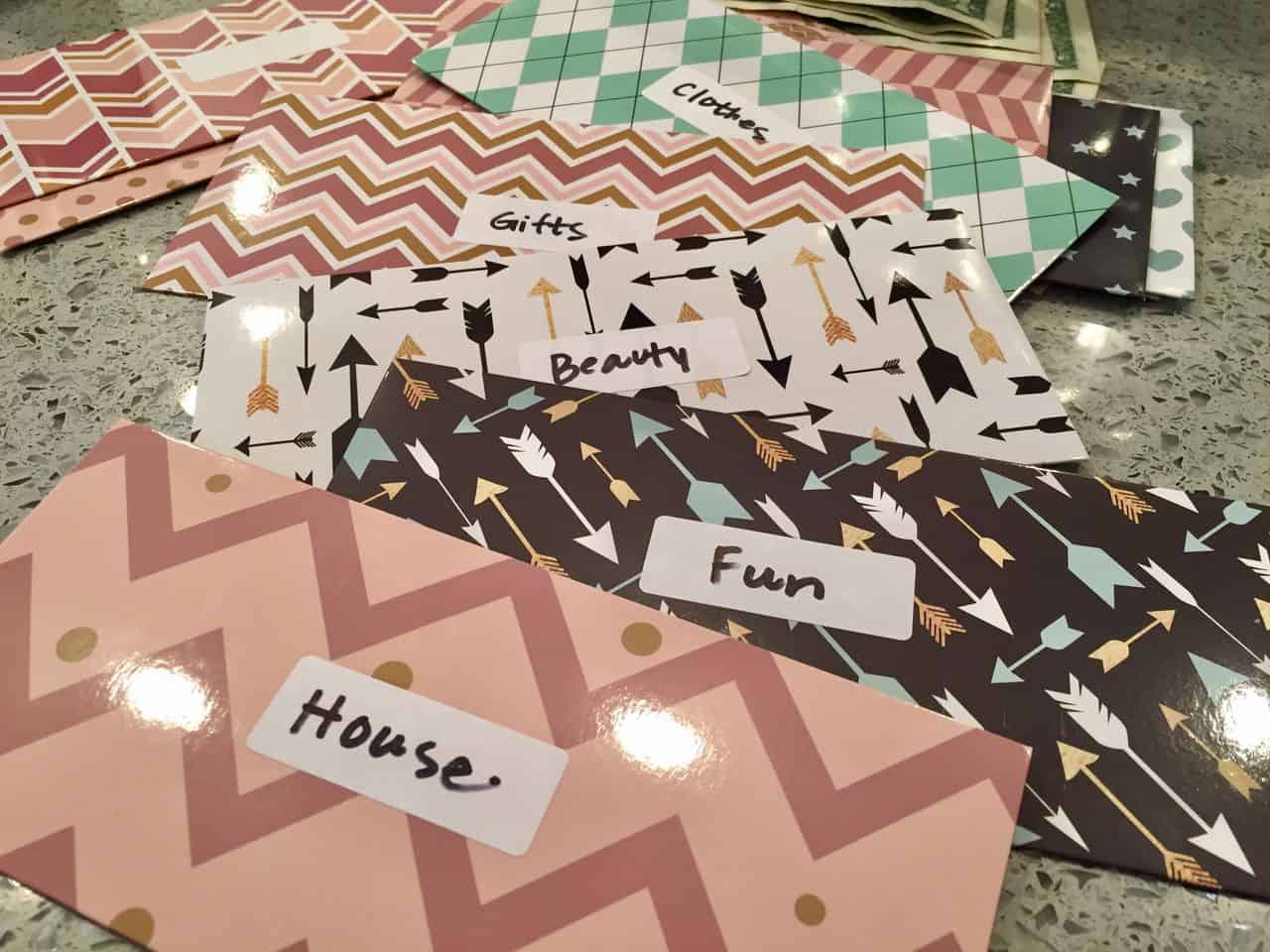

We’ve always done a decent job of managing our finances, and about 5 years ago I was introduced to the ‘Dave Ramsey Financial Peace University’ way of handling money – and I became a fan, and James followed soon after. If you aren’t familiar with the sometimes-eccentric financial guru his philosophy entails paying cash for discretionary items, nixing credit card use, and becoming debt free. I’m so nerdy about this financial stuff now, and get really jazzed up over a budgeting spreadsheet and some envelopes.

In large part due to his financial teaching we paid off all of our debt; student loans, credit cards, and cars – and the only debt that remains is our mortgage. We saved up cash to pay for James’ Camaro. We padded an emergency savings account, increased our retirement contributions, kids college savings, and charitable giving. Budgeting our discretionary money really gave us more spending freedom – our money has a plan. When we’re out of cash for fun for the month…we eat in, and watch Netflix. It still works! We’re now saving up to pay cash for that next item on the list that gets us to Mexico – the tiny house.

One of the primary reasons that we purchased the home that we live in now, is because it has a cash cow in the backyard. Insert picture of cow. Just kidding. We have a one-bedroom apartment above our detached garage that we rent out. It’s 500 square feet and super cute…and it brings in $1,100 monthly income for us without fail. Continuing to rent out the apartment, and also renting out our home is part of my income generating plan. I’m not sure if we’d want to go a more traditional route of a one-year lease, a version of Airbnb or VRBO, or dabble in executive home rentals. Whichever way the plan is for our rental(s) to cover a fair percentage of our income.

James has worked hard to build his own business over the last 10 years. He has steady income, key clientele, and most importantly – he loves his work. I don’t want to mess that up with an imposed sabbatical for him. Much of his ‘busy travel season’ historically has been during the summer months which works out great. We’d be spending those months back in the states at the aforementioned tiny home at Lake Merwin Camper’s Hideaway. Originally, I was thinking that he could just fly out when he had jobs that made that all worthwhile. But after further conversation…I’m not sure that he wants to spend 10 hours and $1,000 round trip to do that for each project. So, this is going to take some more noodling.

I’ve shared My Why with you before about my yearning to stop working a traditional gig, and spend some more time with my girls. Starting to research what type of

business I could create with ideal flexibility, income opportunity, soul-feeding-difference-making value, AND could be taken with me south of the border is a bit overwhelming! My background in leadership lends itself to coaching, speaking, or even writing – but getting a new business off the ground is a daunting task…. just reading and researching is making my eyelids heavy.

In addition to those traditional avenues, many of them can now be done in an online format. Including, course creation, online group coaching and membership. I could fly out and speak somewhere occasionally too when I’m not drafting book chapters beachside. Or maybe I’ll start a side hustle building a business of creating calendar adventures for others. It could be a subscription service delivering calendar adventures to your email or mailbox monthly.

Thanks heavens I put a reasonable timeline out there on this dream move date. A couple of years is what it’s going to take to get this plan ramped up to full speed!

Do you have any brilliant ideas for my business adventure? I’d take ‘em! Any crazy cash envelope comrades out there?

Thank you for joining me on my journey to influence.

– Sarah