Accidents, Credit Cards, and Millionaire Milestones; today we share a Journey to Influence client success story.

Let’s start with credit cards.

Using your rewards credit card for all of your expenses is incredibly convenient.

Pay your phone bill on auto pay?

Fill up the SUV with gas?

Pick up your grocery shopping order?

Order makeup wipes, a book, and mosquito repellent from Amazon?

Cover the tab when you’re out for happy hour with friends?

Click through an ad on social media and order your girls the cutest new dresses?

I get it. I’m with you, it’s so stinking easy and after all, you’re going to pay that sucker off in full at the end of each month. You’ll get all the miles, points, rewards, and never pay a dime in interest. Winner, winner, chicken dinner.

Until, you don’t feel like you’re winning the credit card game anymore. You look up one month and have spent far more than you thought you had, and this seems to be a bit of a trend over the past few months. You transfer money from your savings in order to keep that promise to yourself to pay off that card in full.

Meet Mr. & Mrs. E.

That was my client Mrs. E’s situation when we met for the first time over a strategy call. She was frustrated that expenses weren’t adding up, and admitting to herself that the card had gotten a little out of hand.

I absolutely related to her, as I have done this exact same game in the past. I’m not here to tell you how to use a credit card. If you want to ask yourself a few questions about credit card use I invite you to dig into this blog post. I want to share a story with you about Mr. And Mrs. E’s success. As you may have guessed already, we worked together and sorted through crafting a spending plan, or budget that supported the family’s needs and wants but they accomplished SO much more.

“Our coaching experience was much more than we expected. We were looking for some clarity and accountability. And in the end, we gained so much more! After working with Sarah, we now view our financial life so much more positively and we have way less guilt with our spending. We can live within our means and spend and give without any guilt or over thinking.

During this process we had some bigger money projects happen and also an injury that resulted in income change. This process went so smoothly thanks to Sarah!” Mr. & Mrs. E

What is financial coaching anyway?

Is it simply someone to help explain the financial literacy terms that you don’t totally grasp? Create a budget with you? Look at you sideways when you overspend?

No. Not really. I mean, yes – there are elements of ‘teaching’ and certainly spending plan creation. Asking questions about your goals and plans and how spending aligns with all of that, sure.

But it’s more than that. And honestly, it’s kind of hard to explain because it ends up looking a little different for each and every single one of my clients.

You know why? Because personal finance is, personal. It’s individualized. There are no two individuals or couples that have the exact same income, the exact same life situations, and the same expenses. It’s all unique, and should be treated accordingly.

For me, coaching is meeting someone where they’re at. Being the guide and accountability partner to help them identify their goals and dreams, prioritize them and then make a plan to get to them…all while providing encouraging accountability.

The ‘traditional’ priorities for Mr. & Mrs. E were the following.

- Create a realistic budget for the month/year.

- Prioritize big purchases over the next 1-5 years; replacement cars/home improvement/house payoff.

- Lay the foundation for business finances with percentage based allocations for taxes/operating

expenses/salary and “pad” those accounts with 3-6 months of an emergency fund. - Start contributing a healthy and consistent amount to retirement account.

The gut check emotional priorities for the couple?

His – Better under the expenses and where the money is going each month.

Hers – Lift some guilt with spending, feeling like I “shouldn’t” be spending but doing it anyway.

Together – They needed accountability. To a coach for a bit, but ultimately to each other.

Mr. E. trusted the Mrs. E. explicitly to handle their finances. As a small business owner and tradesman by day, he brought in the money and Mrs. E. managed it, both on the bookkeeping side of the business but also the personal side.

As freeing as it may sound to be 100% trusted to do whatever needs to be done with the finances, it can be quite weighty. There’s a lot of pressure to do the right thing, or the best thing without someone to keep you in check with the overarching goals.

So, first things first – we worked together to establish what those goals were for the couple.

They had an emergency fund.

They didn’t have any debt, outside of their mortgage.

A few home improvement projects were at the top of their list, along with continued fun. Their family enjoys frequent vacations and they wanted to continue to make that a priority.

In addition, adding to their retirement consistently was top of mind as a next smart step.

Where did we start?

Mindset, money stories and good old fashioned communication.

Mr. E. is the quiet type and not only did he sit down at a coaching session after a full day of work to talk with a wife about money stuff, he was doing it with a stranger in the zoom room too – asking questions that he’d never really considered.

Awkward? A little. But the couple working together towards their goals? Key!

Next up, the budget. You knew it. It’s the plan on paper that makes the goals come true. As nearly all goals I know about require some kind of financial commitment, adjustment or change.

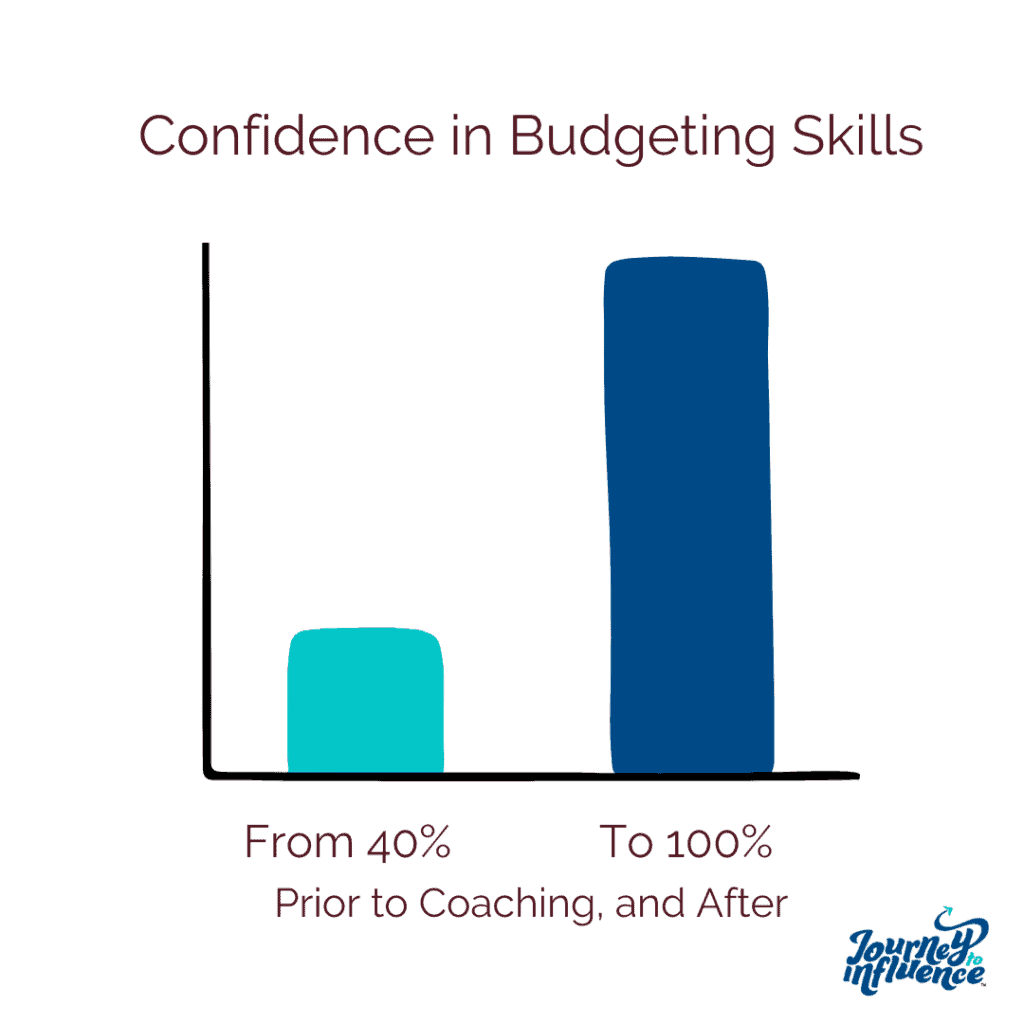

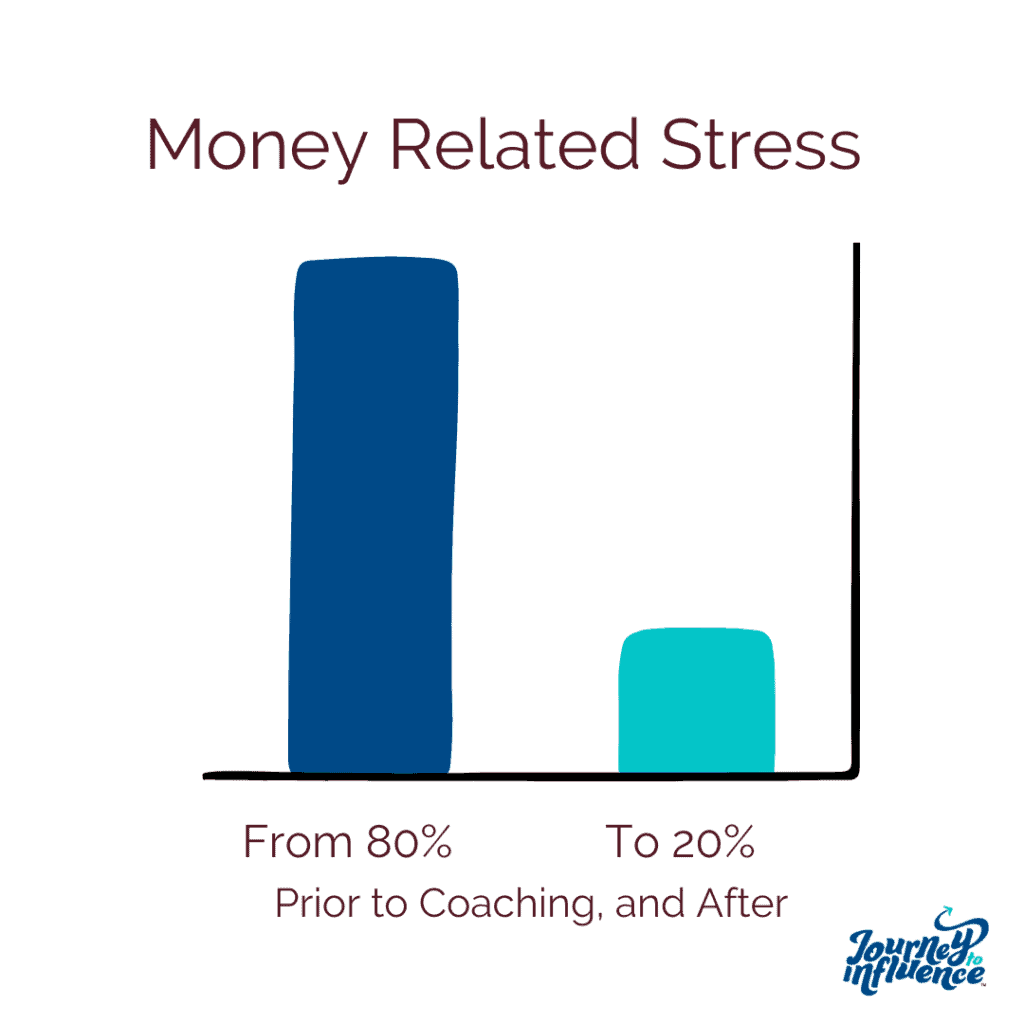

The couple ‘found’ a significant amount of money when they put the plan on paper and started to spend intentionally. In fact, spending went from being an element of guilt to a place of freedom because it was absolutely part of the plan, and the boundaries that they set around their spending still allowed all of their ‘regular’ activities and experiences.

Not only did their budget allow them to cash flow a major home improvement project that year AND contribute 15% of their income into retirement savings, but they had a plan to cash flow their next big purchase too – a new minivan for the fam!

Savings funds for intermittent expenses like vacations, repairs and holidays proved helpful to ‘even out’ the expenses throughout the year. And cash envelopes loaded up at the beginning of the month kept the ‘usual’ expenses of groceries, restaurants, clothing, and household items in check.

Millionaire Moment

Permission to spend, and confidence in their choices to date was part of my challenge as a coach to help them see – the mirror to hold up to them to let them recognize that they were doing a great job overall to date. Were the credit cards a little slippery there for awhile? Yes, but they caught the habit in time – and their overall choices to date were solid. I asked them if they knew what their net worth was during our first coaching session and they said they didn’t know.

When we punched in the numbers of their home equity, assets, savings, retirement and lack of debt…I got to share the news that the couple were in fact millionaires. Every day, regular millionaires. The ones that have one million dollars in assets. If they cashed everything out tomorrow – they’d walk with a cool mil.

I think Mrs. E. Made me double check the numbers and review the spreadsheet sum before she believed me, and believed herself. The couple HAD made some great financial moves and choices in their ten years of marriage, and three babies later. They had invested wisely in Mr. E’s business and continued to make good choices.

The original credit card mistrust of self that transitioned to a true trust in the one’s self was one of the most magical transformations I’ve witnessed to date.

It wasn’t this big swoop of debt to not debt, or little savings to big savings. It was the belief and trust in their own ability.

My heart swells a bit reliving this moment.

Let me tell you about the time that it crashed for a minute when I got this news.

Accidents Happen

Now, I never wish ill on any of my clients – ever. But when life happens during the coaching process, I welcome the opportunity to coach through it. Having someone in your corner when something challenging comes your way, can be so helpful to get to the other side with minimal strain and anxiety.

When I got the message from Mrs. E. that she thought she’d be late for our evening coaching session because her husband was in the Emergency Room after falling from a ladder and injuring his wrists, I knew that not only would we need to reschedule that session (have you seen the wait times in an ER lately?) but we were likely in for some revised planning too.

See, Mr. E is a plumber and uses his hands and arms on the daily in his line of work. He’s also a self employed, solopreneur – keeping a full book of clients that he alone supported. This meant a steep shift in income until he could get back on his feet, err…hands again.

Our next rescheduled session? Mr. E is in slings having broken one wrist, and sprained the other – one needing extensive surgery. We swiftly moved into the planning mode to make sure that the business had a plan to continue; he was able to hire support to cover jobs already in place, but had to pay a steep price for that support cutting into his profit margin significantly. In addition, the out of pocket costs for emergency room visit, hospital surgery, surgeon expenses and follow up care added up to well over $5k in no time.

The plan?

Breath deeply.

Use the emergency fund to supplement any income needed to replace Mr. E’s salary for that period of time and hold tight on any big expenses personally until all of this ‘falling off the ladder’ business was behind them.

The emergency fund from the business came through, and the family’s personal emergency fund didn’t end up getting tapped. The couple focused on healing, and taking care of business without the financial stress and burden that these types of accidents so often cause.

I’m going to pause for a hot minute here and give a shout out to accident insurance (which I turned and picked up for our family right after this ladder incident). Supplemental insurance like accident coverage can help pay you back and cover a gap with medical expenses, time lost on the job, etc. when something like this occurs. It’s relatively inexpensive (I think the plan that James and I have is $600 for the year) and will pay us back a significant amount if we end up with an injury to help relieve any of the financial pressures of bills or loss of work.

Cathy Winslow, of Globe Life Heritage shares this about accident coverage.

Most of us, including me (before learning about supplemental insurance), feel like we’re “over-insured”, right? Well, what if you were injured accidentally and had to take time off work for several weeks, or even months to recuperate? How would that affect you and your family financially?

You see, health insurance is there to help pay the medical bills, but who’s there to help pay for some of your regular monthly bills, when you’re forced to take time off work to heal? That’s where we come in! We pay you cash when an unexpected accident occurs! You can use this cash however you want!! Our accidental injury policy is very comprehensive, meaning that it covers a lot of different scenarios—-from a broken tooth to a broken bone or a dislocated shoulder to a visit in the ER because of a cut that needs to be stitched up. And there’s SO much more that I couldn’t possibly go over during this brief description. If you’re curious about what else is included in our phenomenal (and affordable) accident plan, reach out to me today so I can show you how it works! Bonus! Not only will you learn more about the accident policy, but you’ll also get a free quote and find out why Family Heritage is so much better than their few competitors!! Spoiler alert! What if you got all of your money back after a certain period of time?? You need to reach out to Cathy to learn more!

Email: cwins2020@gmail.com

P.S. Family Heritage also offers 3 other types of policies—cancer, heart attack/stroke, and ICU.

– Cathy Winslow, Globe Life Heritage

Moving Forward

Mr. E. Did indeed get back to work and the original plan continued to march on.

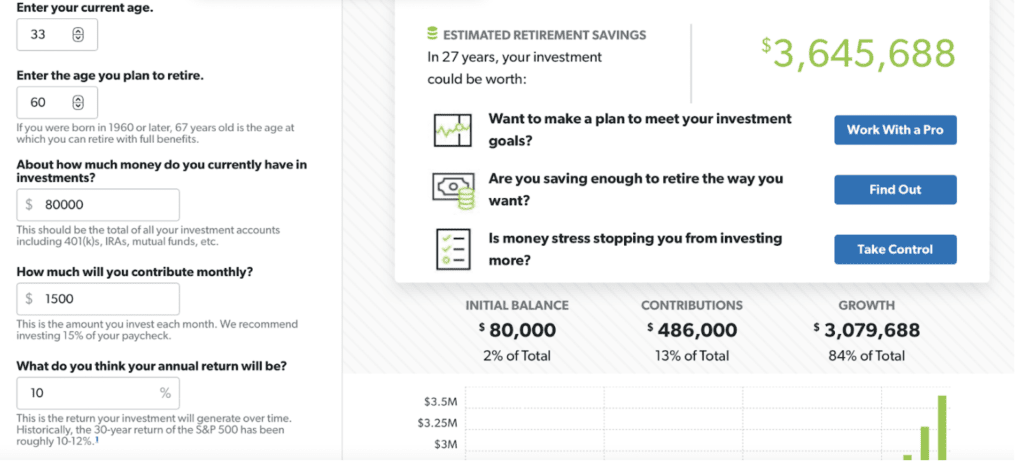

Towards the end of our time together, I wanted to help remind the couple of what a terrific job they’d been doing not only through coaching, but truly with their money management to date. They were on track to contribute $1,500 per month toward retirement and continue to cash flow big projects, replacement vehicles, and continue to live life on their own terms.

Was their retirement goal of hanging up the plumbing hat… Wait, do plumbers wear hats? A quick google search tells me, no. Could they retire at 60? That was the question. The answer.

Looks like it to me!

We punched into the simple retirement projection calculator their age, retirement goal age, current retirement savings amount, monthly savings contribution, average annual return, and wa-la. 3.6 million is the projected amount of their retirement savings at age 60 when the plumber lays down his plumbing tools.

The couple is only going to increase their contribution over time as income grows, and they continue to build wealth.

I think that’s the high note I’ll leave you on.

Coaching isn’t always about crisis intervention, although it certainly can be – it’s more of an opportunity to shine the light on small leaks (no pun intended), unveil the progress and positivity that is right in front of you and assist with a plan to ensure that the dreams you have are within reach.

Intrigued? Apply to see if coaching would be a good fit for you.

Sign up below to get a weekly email with tips, tricks and truth about intentionality with your time, talent and money.

Oh no...This form doesn't exist. Head back to the manage forms page and select a different form.- From Hobby to Thriving Business: The 5 Stages of Small Business Growth

- Top 9 Budgeting Tools to Manage your Finances

- Essential Tax Tips from a Financial Coach

- Money and Love Languages: Strengthening Your Relationship with a Financial Sync

- New Year, New Money Goals: Vision Board for Financial Goals 2025