Let’s face it! Tax season can feel overwhelming, especially when you’re managing the demands of a family, a business, or both. Maybe you’re in the era like I am where we’re trying to get our steps in, hit our protein goals, get the kids to practice and remember to wash your face – twice! I hear it all the time from my entrepreneur clients—“I know I need to be better about taxes, I tend to just push it off.” If that’s you, you’re not alone.

The good news? You don’t have to be a tax expert to get on top of your taxes. As a financial coach, my goal is to help you focus on the small, practical steps you can take to make tax time less stressful and maybe even save some money along the way. Let’s dive into a few approachable strategies you can start today….for next year filing, which is this year. Stay with me.

1. Keep Your Finances Organized

One of the easiest ways to reduce tax-time stress is to stay organized throughout the year. I know—easier said than done. But hear me out: the time you invest in organizing now can save you hours (and headaches) later.

Here are a few simple ways to stay on top of your finances:

- Use digital tools: Apps like YNAB, EveryDollar, or spreadsheets (still my personal favorite) can help you track your income and expenses. If you run a business, consider software like QuickBooks or Wave to manage everything in one place. (QuickBooks is my bookkeeper’s favorite.)

- Separate personal and business accounts: This one’s a game-changer. Open a dedicated bank account for business expenses. Trust me, it’ll make your life so much easier when it’s time to tally deductions. Once they’re open – keep them separate.

- Save your receipts: Whether it’s a meal with a client, a new laptop, or office supplies, keep those receipts. Use apps like CamScanner or Dropbox to digitize and store them so they don’t clutter your desk. You can even just snap a picture and have a folder in your phone you can put on a Google file.

Bonus Tip: Set a recurring calendar reminder for a monthly “money day.” Use this time to update your records, reconcile accounts, and plan ahead… In fact it’s something that I recommend in my CFO Checklist. You can snag it here.

2. Understand Common Deductions You Might Qualify For

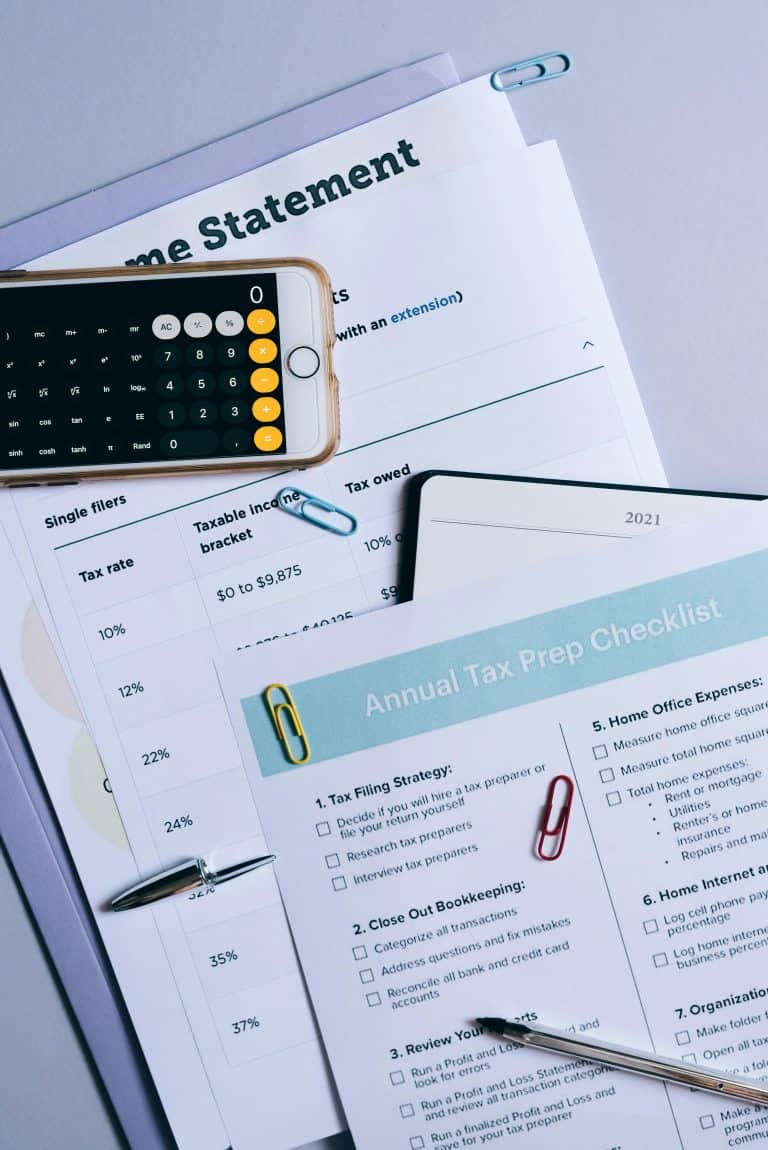

If you’re not tracking your expenses, you’re likely leaving money on the table. Deductions can lower your taxable income, but you need to know what to look for. Here are a few common ones that professionals and entrepreneurs often overlook:

- Home office: If you work from home, you can deduct a portion of your rent, utilities, and internet. Just make sure the space is exclusively used for work.

- Mileage: If you drive for business purposes, keep a log. Apps like MileIQ can track your mileage automatically. MileIQ is a new favorite of mine.

- Professional development: Courses, certifications, and even books related to your work might qualify as deductions.

- Business meals and travel: Meals with clients or travel for conferences can often be partially deducted. Just keep detailed records.

Even small expenses add up. Don’t discount the $10 parking fee or the $25 printer ink—track everything.

3. Set Aside Money for Taxes Throughout the Year

One of the biggest tax-time challenges for entrepreneurs is coming up with the money to pay their taxes. If taxes aren’t automatically withheld from your income (like they are for employees), it’s up to you to set aside money.

Here’s how to make it manageable:

- Estimate your tax rate: A good rule of thumb is to set aside 20–30% of your income for taxes.

- Open a “Tax Fund” savings account: Every time you get paid, transfer a portion of your income to this account. Treat it like a non-negotiable bill.

- Automate it: If your income is steady, set up an automatic transfer to your Tax Fund.

Example: My real estate clients have often been ‘hit’ at one point in their career with a giant bill and have to not only catch up with that giant bill but at the same time start saving for the next year. Don’t be afraid to make a payment plan with the IRS (that you prioritize paying off ASAP) and start to set aside a percentage into your tax fund for the following year, and likely quarterly payments.

Pro Tip: Use quarterly tax payment deadlines as checkpoints to make sure you’re on track.

4. Use Tax-Advantaged Accounts for Big Wins

One of the smartest ways to reduce your taxable income is to take advantage of tax-advantaged accounts. These accounts let you save for specific goals while giving you a tax break:

- Retirement accounts: Contributions to accounts like an IRA, 401(k), or SEP IRA (for business owners) are tax-deductible. Plus, they help you build your future nest egg.

- Health Savings Accounts (HSA): If you have a high-deductible health plan, contributing to an HSA allows you to save pre-tax dollars for medical expenses.

- Flexible Spending Accounts (FSA): Use these for childcare or medical expenses. Just be aware of “use it or lose it” rules.

These accounts don’t just help with taxes—they’re essential tools for achieving your financial goals. If you’re not sure where to start, focus on one account and gradually build up.

You should also talk to your accountant (or Mr. Google) to learn more about filing as an S-Corp to save money on taxes. It’s not without a few headaches, but could be a big tax saving…and could take up its own blog in full. Note to self.

5. Focus on What You Can Control

Taxes can feel unpredictable, but there’s a lot you can control by building solid habits:

- Create a tax checklist: Keep a running list of the documents and records you need, like W-2s, 1099s, and receipts.

- Set reminders: Whether it’s quarterly tax payments or prepping for tax season, use your calendar to stay on track.

- Dedicate time to money management: A consistent routine (even just an hour a month) can help you feel more prepared.

Don’t wait until April to think about taxes. Small, consistent actions are far less stressful than last-minute scrambling, or even buying time for an extension. If you end up owing the clock starts ticking on 4/15 for those payments or 3/15 for corporations including S Corps – and you’ll owe with interest.

6. Lean on Experts When Needed

You don’t have to do this alone! While a financial coach like myself or a coach on my team, can help you organize and plan, there are times when it’s worth investing in other professional help:

- Tax preparers and accountants: These pros can handle the technical aspects of filing and ensure you’re compliant.

- What to bring: Organize your financial records in advance to make their job easier (and keep costs down).

Example: After working together to get her finances in order, my client Jane hired a CPA to file her taxes. The accountant found additional money in deductions, including almost aged out stimulus funds—and she felt confident knowing her taxes were done right.

Wrap Up

Taxes don’t have to be overwhelming. By staying organized, tracking your expenses, and setting aside money throughout the year, you can take control of the process and even save money. Remember, it’s about progress, not perfection.

If taxes and finances feel like a burden, let’s work together to create a system that works for you. Book a free strategy call today, and we’ll simplify your finances so you can focus on what matters most—which could be a lot of things, but definitely not taxes.

Sign up below to get a weekly email with tips, tricks, and truth about intentionality with your time, talent, and money.