Financial savviness can happen to anyone. I have not always been knowledgeable about money management and proper use of investments, tools, and more. In fact, I’m not even sure I could be considered street smart.

Case in point. Our engagement day.

James proposed while we were in NYC on New Year’s Day in the middle of Rockefeller Ice Skating Rink, and we have it on video. We had only been dating for 7 months, but I would have said yes months prior. There was a ring. I was surprised. Moreover, it’s all caught on video.

What really highlights my lack of street smarts comes next….after trading out our ice skates for shoes and making a few needed calls back home to our family and a few friends we headed back to our hotel a few blocks away.

A local man came up to us to ask how our night was. And I told him all about it, along with flashing my engagement ring to him too. He was congratulatory as I was running my mouth full of excitement, as my new fiance kept squeezing my hand – turns out, not out of the same excitement, but the hint to shut up. Not clear. Congratulations transitioned into an ask for some cash to help him have a good night.

Shoot. Naive farm girl must have been written on big letters on my back.

James handed him a $10, and he asked if that was all we could do given our exciting news….and another $20 was forked over. Then we were off, grateful not to have been robbed, but disappointed that my excitement had been taken advantage of for a bit of cash.

Well, that was January 1, 2007 – a lot of time has passed, and although my street smarts are still not the best – my financial savvy has increased in droves.

AND, I want to give you tips and tools to increase your savvy too.

Let’s talk net worth.

Net worth is a simple calculation. Firstly, it helps you track your financial progress. Secondly, it can help highlight opportunities and is easy to check in on regularly to see your growth.

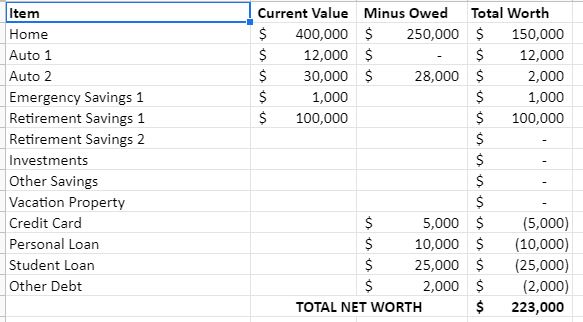

Here is a sample visual of a net worth form.

You can easily do the same for yourself. Bust open a spreadsheet or a notebook – it doesn’t have to be fancy.

List all of your assets; things that you own of value.

- Home

- Vehicles

- Savings

- Retirement

- Recreational Vehicles

- Vacation Property

Then add in your debts to the bottom of that list. You likely still owe on some of the items up above too, but this list on the bottom are things that aren’t holding any value right now that you could ‘trade in’ for money.

- Credit Cards

- Personal Loans

- Student Loans

Next up, circle around to each item and write in their current value. Check out Zillow or Redfin to see your home’s current value. Kelly Blue Book is still the gold standard for vehicle value. Review your other accounts to see where your retirement and savings are. Your debts won’t have any value, so the value column will be blank here.

Moving along, next to that value column is your owed column. Write down what you owe, if anything all the way down the list. You won’t owe any money on your savings or retirement accounts.

Now – a wee bit of math.

For each item, calculate the value minus what you owe to establish what it’s worth. Do this for each item.

For example, your car is worth $30,000. You owe $28,000 on it. The value on your car is $2,000.

Another one, your student loan is worth zilch. You owe $25,000 on it. The value of your student loan is -$25,000.

For your final math problem, you’re going to run down the list of your values. Add it all up, the positive and negative numbers to get your total net worth.

The goal of course is to have a positive net worth, and continue to see it grow. This is how millionaires calculate their millionaire status – when their total net worth reaches a cool million.

Where are you at compared to other Americans? This is not necessarily our goal here, just some info. CNBC recently shared these stats. https://www.cnbc.com/select/average-net-worth-of-americans-ages-65-to-74/

I need to call out the difference between median and average for a minute. Median is the number in the middle. If you had 100 people surveyed in each age group that median net worth is the number smack dab in the middle. Meaning there were 49 people with net worth below that figure, and 50 above. The average takes all of those 100 net worths, adds them up and divides by 100. Those that have a lot…are few, and skew that average.

This article is just to give you a little backstory, not to scare you or inspire you. Do we have work to do to increase our net worth? Sure. But we’re getting it started with knowing how and what to do next.

Your turn, it’s time for you to calculate your net worth and see where you’re at. Where are your opportunities?

Have any debt?

That’s messing up your calculation. The faster you ditch the debt the quicker your net worth will grow.

I recommend peaking in on your net worth every 3-6 months. As you continue to grow in your financial savvy and money management, you’ll see your net worth grow too. It’s encouraging to watch this growth – you’ll see your investments gain traction, as you pay off debt that will automatically increase your net worth too.

Now…if only we had another $30 to put towards our net worth. Ah, lessons learned – sometimes the hard way. We’ve come a long way though on our money journey that really started in 2013, from $700k in debt to a current net worth above our age group bracket average. I was going to give you the actual number here – but my husband just squeezed my hand and told me to keep walking.

Sign up below to get a weekly email with tips, tricks and truth about intentionality with your time, talent and money.