The new year is here, and with it comes the opportunity to set fresh goals and create a financial future that excites you. No, really – financial freedom is exciting, I promise. It buys you options, and January is the perfect time to embrace the “new year, new me” energy—after all, everyone else is doing it. Peer pressure isn’t always a bad thing! When it comes to financial goals, it can actually work in your favor.

If you’re a parent in your 30s or 40s, making good money but still feeling stuck in a paycheck-to-paycheck cycle, it’s time to rethink your approach…our kids NEED us to figure this out! Or maybe you’re an entrepreneur juggling personal and business finances. Either way, the solution is the same: visualize your goals and create a plan to make them happen.

This year, mix things up with a vision board for financial goals. A vision board is more than a pretty collage—it’s a tool that keeps you focused and accountable, helping you stay on track and achieve your dreams.

Why Create a Vision Board for Financial Goals?

A vision board is a powerful way to keep your financial goals front and center. Instead of letting your resolutions fade by February, a vision board keeps your motivation alive all year long with pictures to encourage you along the way.

Take Lauren, for example. The year she turned 40, she decided to create a vision board for her goals for life, family, career, and finances. Her goals included paying off the last of her debt, cash flowing and planning a family vacation, and making bold moves in her career and relationships. By visualizing her goals and breaking them into actionable steps, she achieved more than she thought possible on that 40th trip around the sun.

Key Financial Categories for Your Vision Board

To create an effective financial vision board, make sure to include these key elements:

Primary Goal:

Start with your main financial objective. What do you want to accomplish this year? Examples might include saving $10,000, paying off debt, or increasing your business revenue by 25%. Be specific with your dollar amounts to make your goals measurable.

Habits to Support Your Goal:

Your vision board should include the habits that will help you reach your goal. These could be small but impactful actions, like setting up automatic savings transfers, tracking your spending, or scheduling monthly budget reviews.

Milestone Achievements:

Break your big goal into smaller milestones and celebrate your progress along the way. For example, if your goal is to save $10,000, celebrate every time you hit a $2,500 milestone.

Celebration Plan:

Reward yourself for reaching your goal. This doesn’t mean spending everything you’ve saved! Instead, plan something meaningful, like a weekend getaway, a special dinner, or finally buying that item you’ve been eyeing.

And of course your vision board doesn’t have to be all finances – make it what you need in order to stay focused on your important goals.

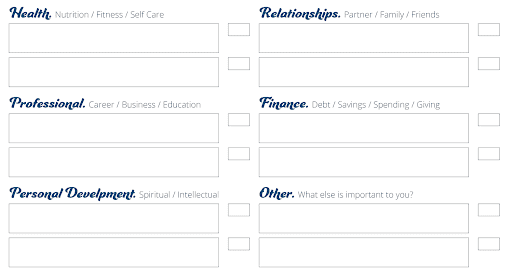

Categories to consider? These are the categories used in the free Goal Planner download that you can snag here.

- Health

- Relationships

- Professional

- Finance

- Personal Development

- Other

How to Create Your Vision Board

Creating a vision board for your financial goals can be as simple or as creative as you like.

Traditional Vision Board:

- Gather old magazines, newspapers, (or print things out from the internet), scissors, glue, and a poster board.

- Cut out images, words, or phrases that resonate with your financial goals.

- Arrange them on your board and glue them down.

Digital Vision Board:

- Use tools like Canva, Pinterest, or another digital platform.

- Search for images and text that align with your goals and arrange them in a visually appealing way.

- Save your vision board as your phone wallpaper or print it out to keep it visible.

- Consider sharing it on social media to add an extra layer of accountability.

Don’t forget to include motivational quotes!

Here are a few to inspire you:

“Being rich is having money; being wealthy is having time.” — Margaret Bonanno

“A dream doesn’t become reality through magic; it takes sweat, determination and hard work.” ― Colin Powell

“Money, like emotions, is something you must control to keep your life on the right track.” ― Natasha Munson

“The more time you spend complaining about what you deserve, the less time you have to focus on what you can create. Focus on what you can control.” ― James Clear

“Stay committed to your decisions, but stay flexible in your approach.” ― Tony Robbins

“The most difficult thing is the decision to act, the rest is merely tenacity.” ― Amelia Earhart

“The secret of getting ahead is getting started. The secret to getting started is breaking your complex overwhelming tasks into small manageable tasks and then starting on the first one.” ― Mark Twain

“It’s better to look ahead and prepare than to look back and regret.” ― Jackie Joyner-Kersee

“A good plan, violently executed now, is better than a perfect plan next week.” ― George Patton

“Wealth is largely the result of habit.” — John Jacob Astor

“We should remember that good fortune often happens when opportunity meets with preparation.” ― Thomas A. Edison

“If you want to live a happy life, tie it to a goal, not to people or things.” – Albert Einstein

“It takes as much energy to wish as it does to plan.” ― Eleanor Roosevelt

Yearly Cash Flow Planning: Mapping Your Annual Budget

A vision board is a great start, but pairing it with a yearly cash flow plan – sometimes we call that a budget… will make your financial goals even more achievable. A cash flow plan helps you visually map out your income, expenses, and savings over the course of the year.

Steps to Create Your Annual Budget

- Review Your Past P&L Statement

Whether it’s for your household or your business, look at your profit and loss statement (or expense history) from the past year. This will give you a clear picture of your starting point in terms of what has happened historically. - Project Changes:

Anticipate changes in income or expenses for the upcoming year. For example, are you expecting a raise or planning a big purchase? Do you have more expenses during sports season for kids? - Assign Percentages:

Business owners; determine what percentage you’re targeting for tax savings, operating expenses and salary. Personally, allocate a percentage of your income or predetermined amounts to categories like savings, debt repayment, investments, and discretionary spending. - Forecast Seasonally:

Identify times of the year when your finances fluctuate and plan accordingly. For example, save extra during high-income months to cover lower-income periods. Be realistic about the fact that you might spend more money on groceries if you’re hosting for the holidays, or more on fuel for summer road trips. Make your plan match your real life!

Avoid These Common Pitfalls:

- Not forecasting at all. Seriously, there is power in simply crafting the plan!

- Failing to plan for unexpected expenses; you need an emergency savings fund!

- Forgetting to consider the predictable, unpredictables; gifts, holidays, repairs, etc.

- Being vague about your goals instead of assigning specific numbers. You don’t have to get this perfect – but you do need to have a target.

Benefits of Forecasting

Taking time to forecast your personal and business finances offers many benefits:

- Clarity: You’ll make better decisions when you understand your financial picture, hands down. Can you bonus your employees? Now, you know when, how much, and why or why not.

- Reduced Stress: Planning for taxes and unexpected expenses prevents last-minute scrambles, and so much pressure on the business or personal side.

- Growth: Forecasting gives you the confidence to invest in yourself and your business, and really start to see the forest through the trees. Once you get your head wrapped around an annual plan you can start dreaming about that 5 year plan.

The Journey to Thrive Framework

To turn your vision board into actionable steps, use this simple framework:

- Dream – Really get clear on where you want to go. No holding back. This is not the time to think small. Go big!

- Prep – Get your head and heart ready for change. Both the logical, pen to paper – mathish type, but also the heart work of habit change and mindset shifts.

- Plan – Create the plan, the budget, the board – do the thing!

- Flex – Stay adaptable as life happens, because it will. Before you toss the plan when &^%$ happens, learn to flex and make adjustments to keep you focused on your overall goals.

- Thrive – Start tackling your goals and celebrate your success; even with small milestone goal celebrations. Take a minute, look back at your progress and then move to the next.

Key Habits for Staying Aligned with Your Goals

The journey doesn’t end once your vision board and cash flow plan are complete. To stay on track, adopt these habits:

- Schedule regular reality checks to review your progress.

- Be flexible and adjust your plan as needed.

- Celebrate small wins to keep your motivation high.

Take Action Today

Don’t let another year pass without taking control of your financial future. Create your vision board and cash flow plan today to start 2025 on the right foot.

If you feel overwhelmed or unsure where to start, don’t worry—you don’t have to do this alone. Book a free strategy call with me, and together, we’ll create a plan that works for you.

To your health and wealth in the new year; or maybe it should be “thrive in ’25?!”

Thank you for joining me on my journey to influence.

Sign up below to get a weekly email with tips, tricks, and truth about intentionality with your time, talent, and money.