Have you ever gone to bed worried about your finances? The math just wasn’t adding up – the money you have coming in, minus the money you have going out – isn’t getting you closer to your goals. In fact, sometimes it feels like your goals are only realistic in a land of fancy unicorns, rainbows without rain, and kittens that don’t grow into cats. Today is a client’s success story on finances.

Stress and anxiety around finances is legit.

- It can cause emotional distress.

- Stress can also wreak havoc on your body and overall health.

- Anxiety huge factor in your emotional well-being.

- Money fights are one of the leading causes of marital strife in our country too.

So, going to bed with stress and worry around finances is not fiction. It is an auto biography for many.

My client, Angela felt some of that same stress around her personal finances. I’m honored that she gave me permission to share part of her story.

Angela knew that she needed to take control of her finances, but the how was elusive. Regardless of what she did, she just wasn’t getting ahead of this grown up money game. Every time she started to make some progress and got ready to pay some extra towards her credit card debt, life would happen – an extra doctor bill, or a trip to the auto mechanic would undo her good intentions.

When Angela and I started to work together in a 90 Day Coaching program she didn’t have any money in emergency savings, and had a couple of credit card bills near the max that kept following her around.

We worked together to craft a budget that would fit her needs – keeping items in the budget that were specific to her, as any good budget should do…

You can’t work of your sister’s budget your best friends’ – your budget needs to be tailored just for YOU.

Some of Angela’s specific budget items?

- Kiddo activities and gifts was important to her as she’s very close to her cute little niece and nephew. Aunt Gigi still delivers, even on a budget!

- Self-care was a mandatory line item for Angela. (And I hope it’s included in your budget too.) What you put in that category is totally up to you! For her it was bi-weekly massage visits; for me it’s a gym membership, a good hair stylist, and the occasional beauty school mani/pedi.

- Auto maintenance fund was another category that Angela utilized. This is a great staple on any budget, and often what will make you dip into your emergency savings quickly if you don’t have a sinking fund like this established. We started off by padding this account early, so that she’d have a buffer – and then moved to a lower recurring monthly amount. When she needs a new battery, a set of tires, and that regular oil change – she’ll have it ready.

Once we had a budget established, we prioritized her first few paychecks to get that starter emergency fund funded with $1,000. Boom. Peace of mind to cover for those just in case moments. Coupled with some padding in her auto maintenance fund, she was set!

Off and running to tackle credit card debts, one at a time – the smallest card balance was demolished and card closed within weeks, and significant progress made on credit card number two in the past couple of months. Angela is projected to have just one card remaining by the end of summer, and the last one will move quickly after that with all her extra funds piling on to it intensely.

Angela’s bigger goals once she gets out of debt? To save up for a small home – talk about a great goal! The goal behind the goal, just like the why behind the why is always so much greater – and a kick ass motivator!

What was even more moving during our coaching was the stress and anxiety that the COVID-19 crisis had for Angela and her family, like so many of us. It presented challenges in her daily activities, work location, grocery shopping situation – you name it. Like many of my clients, I advised her to hold onto those extra payments that she was going to put toward her debt until this blows past us. What a great time to have more safety and security than a time like this.

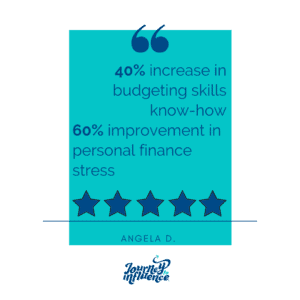

When we wrapped up our 90 Day Coaching intensive with a brief survey, Angela shared these terrific results.

- 40% increase in her own budgeting skills and know how

- 60% improvement in personal finance stress

- 5-star rating for the value that coaching provided

“I am so thankful I have some saving currently with everything that is going on.”

“It was really, really helpful to honestly share my spending with someone and Sarah you are so great at not being JUDGMENTAL. Thank you for your generosity, kindness and genuine desire to help people!!!”

Angela D.

Journey to Influence Financial Coaching Client

Are you ready to find some more financial peace in your future?

Up for a budget plan tailored to your needs?

Ready to ditch the stress of finances and start working on your goals both big and small?

Contact me today to learn more about my coaching plans, and how we can work together to make you the hero of your financial story. It’s sexier than it sounds, I promise.

Sign up below to get a weekly email with tips, tricks and truth about intentionality with your time, talent and money.