My sister filed for unemployment late last week, for the first time in her life and she said that she felt ashamed to not have a job any longer.

See, our parents have instilled a strong work ethic in us (farm girls!) and none of us have ever been unemployed. We’ve been hustling straight out of the womb; I sold gift wrap for some magazine company before I turned 10. Hannah and I worked at the Country Café in high school, and I bet Melissa and I could still put the curl on a Dairy Queen cone.

Of course, she has nothing to feel ashamed of! Her stellar performance is not in question, and she did absolutely nothing to ‘deserve’ it. She is simply, in an industry that is considered non-essential and has closed its doors for a period of time.

She is the first person in my family to be affected by the economic downturn that is COVID 19, but she won’t be the last in my small circle that will be impacted.

If you, yourself are not unemployed, one of your friends or family members likely will be by the end of the month.

When we stop going places, we stop spending as much money – which keeps businesses from paying their bills; and their highest expense is payroll. I’m not telling you anything that you don’t know, and I don’t share to scare you.

I share to prepare you.

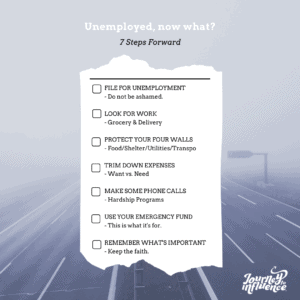

Below are 7 action steps for you to take now, or share later with your friends and family.

- File for unemployment.

Do not, for one-minute feel shameful about this. Your employer pays payroll taxes, including unemployment tax for times such as these.

- Look for work.

This is not the time to go find a similar job, or level up in your professional career. Go find a job that you can contribute to, that will provide both financial support and an outlet with purpose. Jobs in grocery and delivery are hiring right now. Neighborhood kids need supervision. This is not the time to worry about your skillset matching.

- Protect your four walls.

Dave Ramsey’s philosophy of protecting your four walls first is critical. This is how you should be prioritizing your expenses when unemployed.

- Food – no, not the restaurant and take out line items in your budget. Groceries, the staples. And not loads of toilet paper either, the items you need for breakfast, lunch and dinner.

- Shelter – mortgage or rent payment. I’ve heard rumor that the government could give a pass on mortgage or rent payments; which would be another hit to our economy as well. Regardless, have your payment ready after you’ve purchased food.

- Utilities – keep the lights on, the garbage picked up and the natural gas running. You’re going to be home more often that usual, it’s important to keep the place lit.

- Transportation – pay for fuel and insurance for your vehicle to get you to and from the grocery store, and that new job you just picked up.

- Trim down your other expenses.

Alright, it’s time to get serious about your wants versus your needs. Your needs are listed above. Everything else is a want. I repeat, everything else is a want.

Entertainment is going to come via Netflix for $15 per month; it’s time to cut the cable and any outside entertainment. It’s time to re-watch the Lord of the Rings trilogy and introduce your kids to your favorite 80’s flicks.

Eating out is on hold, you’re eating from your fridge and the pantry. You’re making meals together, and teaching your kids how to cook – these are life skills that Home Economics won’t do like you can.

Date nights out have turned to date nights in. An evening stroll hand in hand, a picnic in the living room, or a candle light dinner Lady and the Tramp style is in your future. I predict a whole bunch of Christmas babies!

Self-care might look different for a bit; no longer a massage, fancy skin care or a gym membership – it’s now a hot bath at home, moisturizer and an at home work out.

Gifts are going to take on a different shape and size too. Instead of a gift card to a favorite store, it may be handpicked flowers from your yard, a handwritten letter, or a loaf of fresh baked bread.

Saving for bigger purchases like Christmas and vacations can be paused. We’ll have time for that later.

- Make some phone calls.

Contact every single company that you make a payment to; from the utilities to the credit cards and ask them about a hardship for COVID 19 due to reduction of hours or job loss. Prioritize which bills can be paid, and which will wait.

- Use your emergency fund.

Access your emergency fund if and when you need it. It was made for job loss, and reduction of hours of work. It was made for childcare coverage when your kids are out of school unexpectedly. This is what we save for; rainy Spring days.

If you don’t have an emergency fund, and you are unable to cover the expenses of your four walls with the suggestions above you need to get scrappy. It might be time to sell the car with the high payment. It may be time to auction off that collection of tchotchkes that your husband doesn’t like anyway. Do not take on further debt right now. Your credit card is not an emergency fund. Don’t borrow more trouble and worry for a later date.

- Remember what’s important and keep the faith.

It’s the people in our lives, not the stuff. This crisis is not going to last a lifetime, but rather several weeks.

For those of us that are still employed, you have actions steps too.

- Pause extra debt contributions. If you were tackling your debt like a woman on a mission, I applaud you – you’re my people. BUT I’d rather you stockpile for a bit. As soon as we see the rainbow, you can take all of that extra savings and make those extra payments; you don’t have to lose any ground, just hold tight to it for a bit longer.

- Save up. You can trim your budget too, and put some more money aside for savings. If you don’t have 3-6 months of expenses saved in your emergency savings account – now is a great time to get that moving in the right direction, especially if you are debt free.

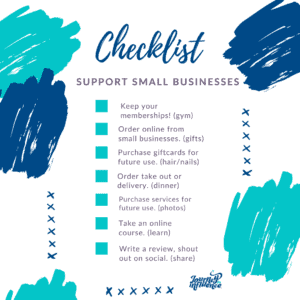

- Support small businesses right now. They need you to help keep them going. If still operating on your ‘normal’ budget make choices about where you shop and who you’re supporting. I created a checklist to remind you of your action steps, and a video to talk you through it.

I hope that this finds you well, and frankly not in need of this advice. But, in the event that you are in this situation right now, or have a friend that is – I wanted you to have a plan.

Sign up below to get a weekly email with tips, tricks and truth about intentionality with your time, talent and money.