Get a sneak peek into the financial story and of the adorable Mr. & Mrs. Parris. Not only will you be charmed by their generosity, inspired by their dedication, and their journey to payoff debt, but I bet you’ll be hands down impressed with their progress in a one year time period.

Perhaps so much so, that you could see yourself making the same progress.

Youngins’

There comes a time in everyone’s life I imagine when you shift from being the younger generation, to the…slightly older, but still beautiful and brilliant generation. When I sat down in the virtual Zoom room of a strategy call with Jacob and Allison I felt myself move from the former to the latter, in slow motion. To be fair, I’d probably been in the “seasoned generation” awhile – but amongst this newly married, energetic and warm couple I quickly knew my place.

Jacob and Allison were doing a good job handling their finances, enjoying married life and working in non-profit career fields that although very fulfilling, let’s be honest – weren’t paying them the same way some of their peers were getting paid for like work in for-profit industries. They were uncertain if the ability to pursue their dreams of debt payoff, home ownership, and all that goes with raising a young family was realistic in the near future in their situation.

They didn’t consider themselves “bad” with money, but also not entirely as intentional as they knew they could be.

Sound familiar?

During our kickoff session we started to look inside their money stories, and better understand how their past money history – especially the growing up years – impacted their present state and money relationship.

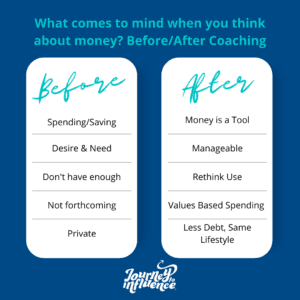

The first question out of the gate in the smattering of kickoff questions; what are the first few words that come to mind when you think about money?

Allison used words like, generosity (I just adore her heart), spending, saving, desire, and need.

Jacob painted a visual with the phrases; don’t have enough, not forthcoming, and private.

You can see how coming together with different backgrounds, experiences and perceptions can not always be a walk in the park for couples. Recognition, awareness and understanding come into play as singles become couples and put their money together along with so many other aspects of doing life together.

Sidenote…I had another client joke about what date the money topic should come up. I think we landed on #3. Long enough to know you like hanging out so far, but early enough that you can cut bait if the intentionality level there is sub par.

Back to the the Parris’ kickoff session.

How would you describe your relationship with money? Committed? Complicated? On again, off again? Here’s how the couple described theirs.

Jacob shared that he’d never had a great relationship with it, and recalled stories of growing up understanding that there were sacrifices made and pennies sometimes were pinched – giving him the natural inclination to keep a tight hold of it, with generosity not a first reaction.

Allison indicated that she and money were friends; always comfortable growing up and never over hearing about money challenges from her parents, counting her blessings to have savings, and not stressed out or worrying about money.

Are you wanting to improve your financial story?

Start with your past. Reflect. Understand. Determine the areas that served you, and the ones that didn’t. Recognize where you’re at – and then dive into where you want to go.

Goals

The couples’ goals probably sound pretty familiar to most twenty-somethings; student loan pay off, fully funding an emergency fund, saving for a down payment on a home, and maybe upgrading that car that’s perfectly functional but…could really feel like full on adulting just a few years newer.

Jacob and Allison were very well aligned with their goals for the future. This may not be your situation – and that’s okay. I recommend hearing out your partner and understanding their goals, sharing yours, and finding the common ground in all of that to work on – together.

“Many ideas grow better when transplanted into another mind than the one where they sprang up.”

Oliver Wendell Holmes

With a good review of the past, and dreams for the near future identified we could map out our plan.

The Budget

This “budget” word tends to get people a little anxious. It sounds restrictive, but it doesn’t have to be. Sometimes I like to call it a spending plan. Helping this couple create a realistic monthly budget to intentionally use “every dollar’ that came in was key to their progress moving forward.

What happened next?

Awareness. Some trimming of unnecessary spending; a few subscriptions, and a bit of impromptu eating out. Increased planned spending in other areas; gifts, seasonal items, and giving were a few. That’s right, increased spending. Planning for intermittent expenses like; vacation, holiday and repairs were also built into the plan. No more surprises. Well, less surprises anyway – a budget is not full proof against all that life will throw your way – but it certainly can help predict some of the unpredictable.

You know what else we found in the budget?

On average an extra $1,200 per month to go towards their goals. That’s right $1,200 was ‘leaking’ out of their wallets on a regular basis. Those funds got swooped up and put into savings ready to write checks for student loans as soon as those post-COVID pauses kicked back in.

There were emergency fund adjustments, extra paychecks to make plans for, and small celebrations amidst a whole lot of regular life, all along the way with these two.

One of my favorite messages from Allison included the couples visual tracker of their debt payoff; coloring sheets to track their progress. You can get something similar like this with a quick Google search.

The mantra: Debt free in 2023!

The couple has put a whopping $35k towards their debt payoff, has an established emergency fund of $10k and will be able to use the student loan debt forgiveness program (theoretically if all goes through) to relieve $20k of their debt – making that debt payoff now turn into a very healthy start of a home down payment savings fund…and a growing family!

Eek! I can’t wait to see little baby Parris’ running around in the front yard.

When surveyed, the most impactful swing was in the Parris’ budget skills and confidence went from 35% to 90%!

“Personal finance coaching has really set us up well for the future in so many ways. We feel confident in where our finances are right now, and where we want to go for the future. Sarah has given us the tools to budget well and to know how to adapt it as life changes. She made us love budgeting and sitting down each week to reconcile our budget, something we never thought would be the case! We feel way more freedom with our money and we are now excited about our future financial goals and how we will get there. Those goals also seem way more attainable and realistic. We truly feel like this coaching with Sarah has given us tools and habits that will last the rest of our lives and we are so grateful!”

Jacob & Allison Parris

Fast forward to our final wrap up session and I asked that first question all over again; what are the first few words that come to mind when you think about money NOW?

Allison’s update highlighted using money as a tool, and alongside what’s important to you. Jacob shared, “manageable, rethink what you do with it, lifestyle didn’t change – but we have less debt now.”

Can we compare those thoughts side by side for a minute? The shift in perspective, positivity and attainability is palpable.

How about that relationship with money now?

Jacob, “I’m more confident in understanding money and putting my mind to it. We are holding ourselves accountable to doing what we want with our goals, and it’s only getting better. We have good habits in place.”

Allison, “There’s a lot of freedom in it, we’re so excited to pay off debt in the short term and have Christmas money set aside, money in our budget for going out, and permission to spend!”

This is where it’s at friends. Freedom, flexibility, intentionality – it’s all packaged up in an incredible journey, to thrive with your finances. Such a treasure to walk alongside these two.

Can’t wait to see you have the same results too. Curious? Let’s chat.

Sign up below to get a weekly email with tips, tricks and truth about intentionality with your time, talent and money.